Understand PCI Compliance Levels

Overview

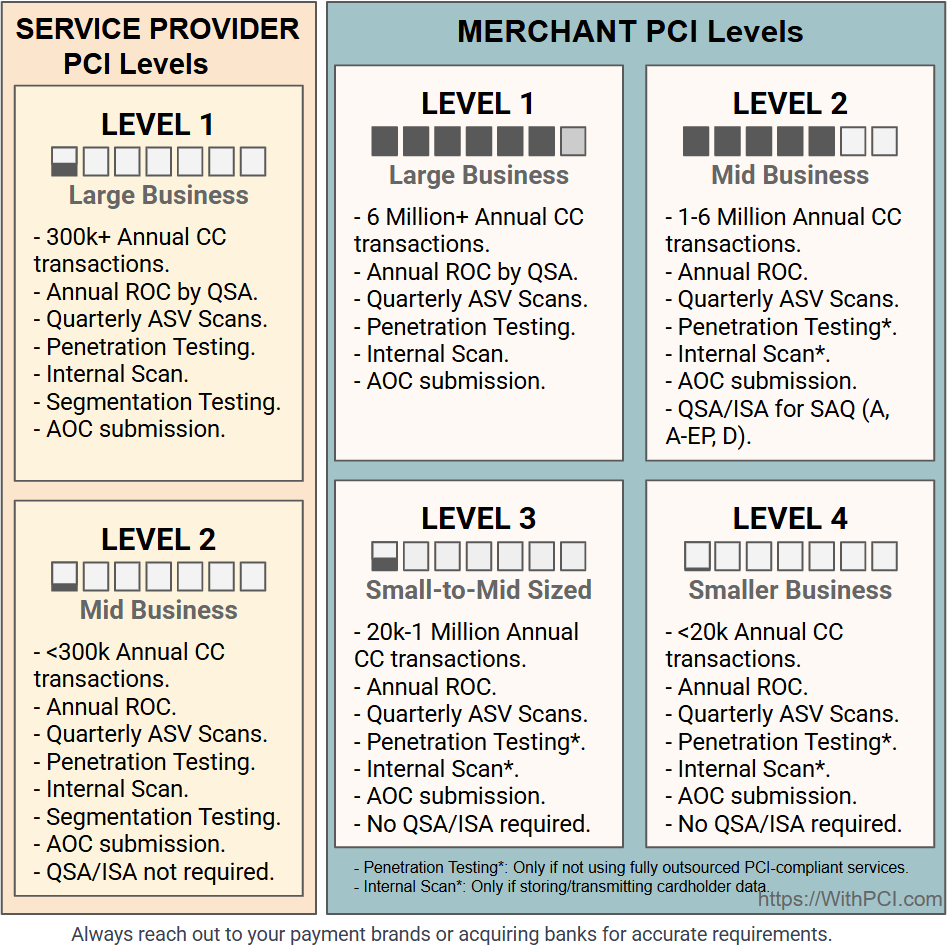

This visual guide illustrates the different PCI DSS (Payment Card Industry Data Security Standard) compliance levels for both merchants and service providers, with transaction thresholds and key requirements.

Merchant Documentation

- Level 1 Merchant PCI Compliance

- Level 2 Merchant PCI Compliance

- Level 3 Merchant PCI Compliance

- Level 4 Merchant PCI Compliance

Service Provider Documentation

Detailed Compliance Requirements

Key Requirements Legend

- ROC: Report on Compliance

- QSA: Qualified Security Assessor

- SAQ: Self-Assessment Questionnaire

- ASV: Approved Scanning Vendor

- ISA: Internal Security Assessor

- AOC/AoC: Attestation of Compliance

- DESV: Designated Entities Supplemental Validation

Important Notes

- The AOC for Level 2 merchants and service providers should be signed by an authorized company executive. However, due to varying requirements from different payment brands, it's essential to verify whether additional signatures from a QSA or ISA are necessary for compliance.

- Compliance requirements may change over time as the PCI Security Standards Council updates the standards

- Some card brands may have additional requirements beyond the standard PCI DSS requirements

- Businesses should consult with qualified security assessors for the most current compliance information

- The classification levels may vary slightly between different card brands (Visa, Mastercard, American Express, etc.)

Your perspective on this PCI DSS requirement matters! Share your implementation experiences, challenges, or questions below. Your insights help other organizations improve their compliance journey and build a stronger security community.Comment Policy